แก้ไขปัญหาเรื่องการโกงเงิน ปิดยูสเซอร์ ล็อคยูสเซอร์จากตัวแทน เว็บของเราไม่ผ่านเอเย่นต์มีไลเซินซ์คาสิโน ถูกกฏหมายในต่างประเทศ เว็บแทงบอลที่ดีที่สุดในประเทศไทย แทงบอลขั้นต่ำ 10 บาท ราคาน้ำ 4 ตังค์ คืนค่าคอม 0.5% –…

8 Important Harmonic Patterns Every Trader Should Be Using

Yes, identifying PRZ is the goal and actually the only goal for a pattern. Of course, as you note, all such targets are “potential” action points whether generated by Fibonacci patterns or other types of studies. Other than when automated trading is used, such “potential” xabcd pattern CITs are always discretionary with respect to taking action. As far as history of earlier patterns are concerned you can restrict the exploration to look for the last formed pattern based on existing parameters-. Maybe we can try to look at developing some code for that.

Ironically, the bullish ABCD pattern begins with a sharp move downwards. Nowadays bloggers publish only about gossips and internet and this is actually irritating. A good web site with interesting content, that is what I need. Thank you for keeping this site, I will be visiting it. BC retracement range is from 261.8% to 361.8% of BC. It retraces 0.382 to 0.886 of aB or 38.2% to 88.6% of AB.

Examples of Gartley Pattern with Entry rules

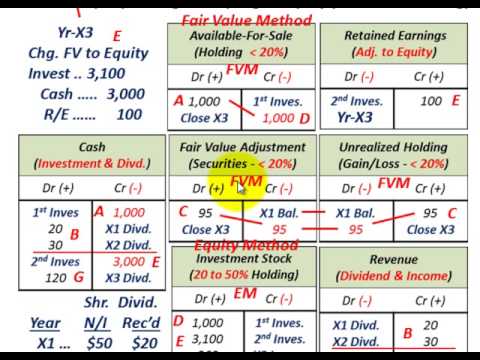

Harmonic trading within the currency market consists of the identification and the evaluation of a handful of chart figures. In a lot of the instances these patterns consist of 4 price strikes, all of them conforming to specific Fibonacci ranges. Therefore, a harmonic chart sample should at all times be analyzed using Fibonacci Retracement and Extensions tools. This can be an advantage, because it requires the dealer to be patient and wait for ideal set-ups. We have a five-points set up with the Gartley pattern labeled XABCD which are following the Fibonacci ratios.

But, in any case you need to prepare to sharpen your skills to trade harmonic patterns. XABCD harmonic pattern falls into the category of the retracement patterns, all having a D point that does not go beyond the X point of a pattern. Different retracement XABCD harmonic patterns can be used in ranges or channels, so, you have to be sure to know which one to apply in which situation. It is also worth remembering that the value may increase again later in the day. This is another reason that the investor should not run the risk of holding out when the value dips past the investment point plus the risk value.

show that each of the relation R in the set A=x belongs to z:0 is less than or equal to x is less than or equal to 12 given by

These chart patterns can be further classified into simple and complex types. Besides the simple types of patterns, the complex type consists of a combination of simple patterns and previous swings. Understanding these patterns and knowing their properties give a trader a great advantage in trading and the ability to cope with different trading environments.

@Capsule91, please have a look at Sintex industries, whenever you find some time. The harmonic theory pattern is based on the price movements concerning time. It is found that such price/time movement adheres to the symmetry found in the Fibonacci sequence. The Fibonacci ratios work well with market movement. Combining geometric figures with Fibonacci ratios using price data we find the Harmonic pattern.

If the retracement of move BC is .382 of move AB, then CD should be 2.24 of move BC. Consequently, if move BC is .886 of move AB, then CD should be 3.618 extension of move BC. A common saying among members of the financial community is that past performance is not indicative of future results.

Gartley in his book Profits in the Stock Market, originally written in 1935. Since then, a number of authors/traders have improved harmonic structure, one in particular is Scott Carney. Harmonic patterns, however, are established through clear price structure and Fibonacci measurements.

- Gartley discusses the Gartley sample and refers to it as “top-of-the-line trading opportunities” out there.

- The pattern begins with identifying point A, the initial spike, which is a significant high.

- If I could just get this step to work it would help automate my daily analysis considerably.

The use of Fibonacci ratios makes them use standardized set-ups. These patterns are stable and reliable and the accuracy percentage is high. BC retracement level ranges from 38.2% to 88.6% of AB. The AB retracement line should lie between 38.2% to 61.8% of XA. If it retraces further, the lowest point of the candle should not touch the 61.8% of XA, point.

At point 2, the value reverses once more toward point 3, which ought to be a 38.2% retracement from level 1. Notice the adjoining bottoms of these peaks create a small bullish trend line on the chart , which we are able to use to settle a ultimate exit point on the chart. The breakdown via this pattern line may be very sharp and it is created by a big bearish candle.

The most used Harmonic patterns are:

Once support has been established at , you are almost ready to enter a short position. The price should begin to rise from its support at up to a new high. Once the price reaches , this is the optimal point to enter a short position.

Most technical merchants use chart analysis with market context ideas to trade. Each trader develops his personal market context to commerce. The primary harmonic patterns are 5-point patterns. Most technical traders use chart evaluation with market context ideas to commerce.

These patterns are precise and therefore have high accuracy levels. But inside a chart when a pattern is visually confirmed, the price points must be confirmed using the Fibonacci ratios. If the price points do not agree with ratios, the pattern is invalid.

What Are Harmonic Patterns?

There will be 2 internal loops first one will print spaces and the other will print the character. You can see in this pattern character is changing throughout the row but reset to A after every row. To change the character in every iteration you can set a counter and increment it by 1 every time in the inner loop. To create this simply create 2 nested for loops where the outer loop repeats a row and the internal loop prints the character in a column. Is quite excited in particular about touring Durham Castle and Cathedral. Market prices at all times exhibit development, consolidation and re-development conduct.

What is ABCD pattern in a downtrend?

AB and CD tend to have approximately the same size. A bullish ABCD pattern follows a downtrend and means that a reversal to the upside is likely. A bearish ABCD pattern is formed after an uptrend and signals a potential bearish reversal at a certain level.

Examples of these patterns embrace Head and Shoulders, Double Bottoms and Broadening Patterns. These can be used to help in the effectiveness of the harmonic sample and enhance entryand exitperformance. Several price waves may exist within a single harmonic wave . Prices are continually gyrating; subsequently, it is very important focus on the larger picture of the time frame being traded. In a bearish trend, point A is significantly low when point B is considerably high.

The stop-loss and target prices are similarly done using the Fibonacci ratios. X is a random point from which we have tried to construct the pattern. Again C, to which the price goes up from B, is at 0.382 or 0.886 of AB. Using these numbers we find important price points which are then employed to find a geometric pattern. Using the belief that the patterns repeat themselves, we use these patterns to project future price movement.

Since the advent of Harmonic patterns, researchers have done much research on Harmonic patterns. Later others have come up with a few other patterns. The Harmonic patterns can be divided broadly into the following categories. The projected price is not pure guesswork, as you can see. These are found to be pretty accurate most of the time. Harmonic patterns are far more accurate than visible patterns like Morning Star, Engulfing patterns or any standard oscillators.

It’s lots of info to soak up, however that is tips on how to learn the chart. The worth moves as much as A, it then corrects and B is a 0.618 retracement of wave A. The price moves up through BC and is a 0.382 to 0.886 retracement of AB. The Gartley sample above exhibits an uptrendfrom point 0 to point 1 with a value reversal at level 1. Using Fibonacci ratios, the retracement between level 0 and level 2 must be 61.8%.

What is an Xabcd pattern?

What is the XABCD Candlestick Pattern? Developed by Harold McKinley Gartley, the XABCD is a trend reversal pattern with five separate points (XABCD) and four legs (XA, AB, BC, and CD). The pattern can be a bullish pattern or a bearish pattern, and, in any matter, it indicates that the price action is about to reverse.

We also have training on the way to trade with the Gartley sample. Gartley, this sample is the most regularly used in the harmonic trading group. Using Fibonacci ratios, the Gartley sample seeks to establish cases of breakouts, resistance, and support.

How to use abcd pattern in tradingview?

Users can manually draw and maneuver the four separate points (ABCD). The ABCD points create three separate legs which combine to form chart patterns. The three legs are referred to as AB, BC, and CD. Each of the four points (ABCD) represent a significant high or low in terms of price on the chart.

This Post Has 0 Comments